News

News

Messaging app Slack has had a transformative effect on thousands of businesses worldwide. With a flotation expected, Paul Levy asks if shareholder pressure and influence bring with it the quest for short-term returns at the expense of longer-term creativity and innovation.

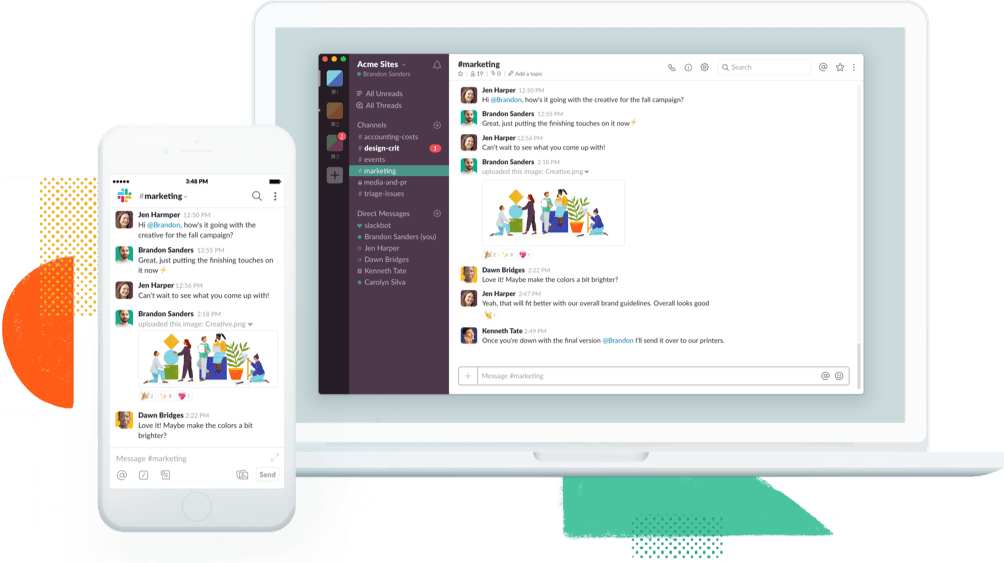

Slack, the collaboration platform favoured by designers, developers and an increasing number of companies, is rumoured to be planning an IPO. In similar fashion to Spotify, it is reportedly considering going direct to market instead of using one of the household banks as an underwriter.

One suggested reason is that Slack’s investors can get out fast. A direct listing is a way for the company to grow and attract funding in the most direct and least expensive way.

Slack fans have reason to be concerned. We are not talking buyout and takeover (yet). But we are talking a move that may bring shareholder pressure and influence, and with it the quest for short-term returns at the expense of longer-term creativity and innovation.

The current figures show how quickly Slack has grown. One estimate by financial news watchers Barron’s is “$300m of annual recurring revenue which has more than doubled in the past two years”. In 2018 it was estimated to have reached 8m daily active users with 3m paid users.

For many individuals, groups, communities and entire large corporations Slack is becoming a core process for team meeting, product and process development, core decision making, information sharing and is even replacing email as a default mode of communication. A lot of people love the platform because of its independent roots, its independent spirit of innovation, its culture of plug-in tools and collaborative values. The company will have to be careful not to lose this appeal as it grows and gains more outside influence.

With growth comes opportunity and the suggestion that Slack will publicly float this year isn’t surprising. The question that arises is, as with full acquisitions, will the landscape of shareholding quickly change and pressure the company to go for quick income, and drive risky and exciting innovation off the radar?

Success is not a given for any growing company. IPOs and buyouts can bring new opportunities, open up markets and enable investment in new product innovation. But the innovative, often boundary-pushing spark of smaller disruptive startups can be snuffed out as they become more established and try to appeal to a mass market.

There are, of course, risks from bigger competitors with established reach into larger corporations such as Microsoft’s Teams program, which was built to directly compete with Slack. Growth that comes from a public listing may be inevitable, but it comes with risks, and there may be a price to pay, depending on who invests and why. Private investment does have the advantage of being able to seek backers that align more with a company’s ethos and values.

Many innovative digital startups have been acquired by larger corporations who gobble up their originality and innovative capability. This is often to the horror of grassroots, early-adopter customers who feel these digital pioneers have sold out to mediocrity and risk-averse dinosaurs. And the evidence is certainly growing that, as shareholder influence from outside becomes more prominent, innovation can get sacrificed in the pursuit of corporate mediocrity and shorter-term gains.

This is a classic story of how digital startups can get eaten up – as happened with the social network Yammer. Another oft-quoted example of how innovative initial products can become scuppered is Skype, which was bought by Microsoft in 2011. From independent-spirited, game-changing startup, Skype is now a product set within the rules and desires of a big corporation and has lost users as a result.

There are no definitive studies of how public listings of digital firms either stimulates or stifles innovation over time, though there is certainly anecdotal evidence. The view that “prevailing stock market ideology enriches value extractors, not value creators” is increasingly stated. It can indeed suppress and even kill off innovation.

For platforms such as Slack, this relates to being proactive and responsive in relation to its current and potential user base, taking risks, being bold, creative and boundary breaking. Will a public listing attract those looking for more guaranteed rewards? Much will depend on the level and type of new shareholder influence and interference.

What we do know from the research is that when shareholders intervene more, this tends to block innovation and ultimately impacts the bottom line. For Slack, this could look like underfunding for innovation and limiting risk taking and creativity. Or if higher revenues are sought through selling user data or partnerships with corporate interests, for example, this could hurt the brand’s popularity with users.

This is a risk for those who have committed to Slack in order to change their workplace culture towards something more collaborative and smarter working habits. Slack reaches deeply into that culture and that commitment could prove to be damaging if the product is diluted or changed in ways that stifle that culture change.

There is no evidence that this will happen with Slack, but it is worth posing the question: will Slack lose its grip on its founding values and innovative roots as new shareholder interests start to take hold? Those who have embedded Slack into their company cultures might just need a Plan B.

Paul Levy is a senior researcher in innovation management at the University of Brighton. This article is republished from The Conversation under a Creative Commons licence.